"Kench" Term Deposit

|

Type of deposit |

Urgent |

|

Minimum deposit amount |

1000 KGS; 20 USD; 1000 RUB |

|

Additional contributions and restrictions on them |

- |

|

Frequency of interest payments |

monthly |

|

Interest capitalization |

- |

|

Partial deposit withdrawal |

- |

|

Interest payment upon early termination of the contract |

at the rate of the deposit “On demand” |

|

Peculiarities |

- |

| Contract Extension |

Automatically at the interest rate applicable on the extension date |

* Maximum effective interest rate: KGS - 14,94%, USD - 2,02%, RUB - 7,25%

Attention, the client has the right to independently choose the duration of the deposit between the standard terms of the deposit product. For such cases, the following principle of setting interest rates is applied: the interest rate of the standard period applies to all deposits concluded for a period up to the next standard period according to the interest rate scale of the deposit product.

|

Currency |

1months |

3 months |

6 months | 9 months | 12 months | 18 months | 24 months | 36 months |

| KGS | - | 3% | 6% | 8% | 10% (+2%) | 10,5% (+2%) | 12% (+1%) | 13,5% (+0,5%) |

| USD | - | - | - | - | 1% | 1,5% | 2% | - |

| RUB | 5% | 6% | 6% | 6,5% | 6,5% | 7% | - | - |

*For amounts over KGS 5,000,000, on the basis of a written request from the client, the Bank's management may consider individual interest rates.

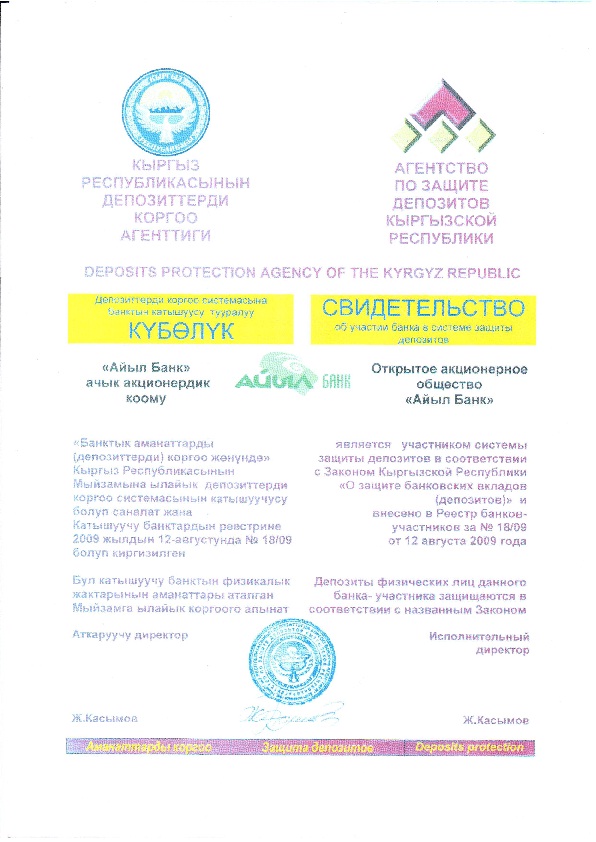

Aiyl Bank OJSC is a member of the deposit protection system in accordance with the Law of the Kyrgyz Republic “On the Protection of Bank Deposits” and is included in the register of participating banks for 18/09 of August 12, 2009.

For all questions, please contact the Head Office or subdivisions of Aiyl Bank OJSC.

The Bank reserves the right to change the established tariffs depending on market conditions, as well as by agreement with the client to set individual tariffs / rates on deposits, cash management services, according to the decision of the authorized bodies / persons of the Bank and in accordance with the legislation of the Kyrgyz Republic.