Savings deposit "Araketke-Bereket"

|

Restrictions |

The loan is issued in Kyrgyz soms. The deposit must be in the name of the borrower. |

|

Deposit interest rate |

Deposit funds are attracted at 3% per annum. |

|

Type of deposit |

Cumulative |

|

Deposit term |

- 12 months; - 24 months; - 36 months. |

|

Minimum deposit amount |

10 000 KGS |

|

Additional fees and deposit restrictions |

a) Not less than 5,000 KGS b) Acceptance of additional deposits is terminated 30 days before the expiration of the deposit Agreement.

|

|

Periodicity of payment of interest on the deposit |

At the end of the term.

In case of early termination of the deposit agreement, the payment of interest is made at the rate of the deposit "On Demand".

|

|

Interest capitalization |

No |

|

Partial deposit withdrawal |

No |

|

Additional terms |

1) After one year, from the moment of accumulating a deposit of at least 50% of the amount of the received loan/mortgage, the depositor is given the opportunity to issue a loan/mortgage in accordance with this product.

2) In the case when the depositor makes an even, monthly amount for three years, after accumulating a deposit in the amount of at least 50% of the amount of the loan/mortgage received, the depositor is given the opportunity to issue a loan/mortgage in accordance with this product, upon expiration of the deposit term contracts.

3) After one year, from the moment of accumulating a deposit of at least 30% of the amount of the received loan/mortgage and accrued interest for one year, the depositor is given the opportunity to issue a mortgage/loan according to this product, at the discount rate of the NBKR + 6 (six)%, at the time of registration of the mortgage / loan.

When applying for a mortgage, the amount of the accumulated deposit is calculated as the initial contribution.

The depositor has the right to receive a loan/mortgage within six months from the expiration date of the deposit agreement. |

|

Interest rate |

1. Mortgage - 12% per annum; 2. For other types of loans - 14% per annum. |

|

Funding Method |

- credit |

|

Loan amount |

The maximum mortgage amount should not exceed 70% of the value of the purchased property. |

* Effective interest rate: KGS - from 17.38%

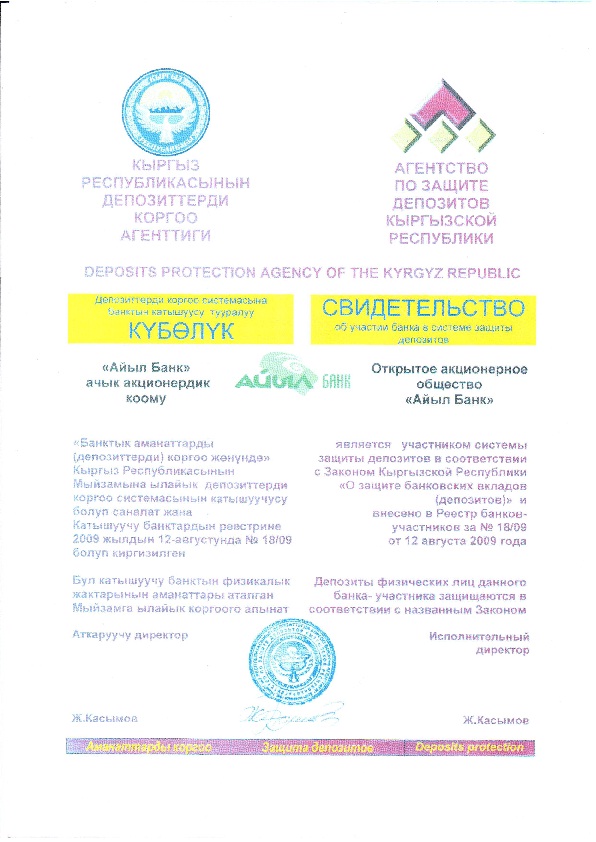

Aiyl Bank OJSC is a member of the deposit protection system in accordance with the Law of the Kyrgyz Republic “On the Protection of Bank Deposits” and is included in the register of participating banks for 18/09 of August 12, 2009.

For all questions, please contact the Head Office or subdivisions of Aiyl Bank OJSC.

The Bank reserves the right to change the established tariffs depending on market conditions, as well as by agreement with the client to set individual tariffs / rates on deposits, cash management services, according to the decision of the authorized bodies / persons of the Bank and in accordance with the legislation of the Kyrgyz Republic.